Concentration of spending reshapes transport and hospitality capacity

Projected $544 billion in annual leisure expenditure by the top 10% of U.S. households in 2026 is already influencing airline seat allocation, cruise ship deployment, and marina berth utilization, forcing carriers and operators to recalibrate capacity and premium service offerings.

Key findings from the 2026 luxury travel analysis

A recent industry study by Resonance Consultancy with research firm Léger reports that the top 10% and top 1% of American households now account for more than half of total consumer spending, with travel showing the strongest concentration. Surveys of affluent cohorts indicate pronounced differences in trip frequency, per-trip spend, and product preferences that have direct consequences for transportation logistics and destination planning.

Trip frequency and spending by cohort

Affluent travelers are taking more trips at higher price points, prompting shifts in scheduling and resource allocation across modes:

| Group | Average leisure trips/year | Average spend per trip |

|---|---|---|

| Top 1% | 6.0 | $12,400 |

| Top 10% | 4.3 | $7,900 |

| Average U.S. traveler | 2.8 | $3,700 |

These differences translate into higher demand for premium cabins, private transfers, bespoke excursions, and exclusive port calls. Carriers and marinas responding to this demand are prioritizing flexible berth allocation, upgraded tender operations, and concierge logistics to reduce turn times and enhance guest experience.

Shifting product preferences: wellness, cruising, and boutique hospitality

The affluent segment is moving toward three dominant categories that affect maritime and hospitality supply chains:

- Wellness and longevity travel: A rising share of wealthy travelers seek health-focused itineraries and resort programs, increasing demand for dedicated wellness facilities and medical tourism partnerships.

- Cruising and yachting experiences: Interest in cruising among the top 1% rose substantially; new ultra-luxury lines such as Ritz-Carlton Yacht Collection 和 Four Seasons are deploying smaller ships and private-guest logistics tailored to high-net-worth clients.

- Luxury hospitality and branded residences: Developers are favoring smaller, high-end hotels and integrated residence-club models, which concentrate spending into fewer, higher-rate units and affect local real estate and service labor markets.

Destination dynamics and international routing

Geographic preferences among affluent Americans are evolving in ways that influence airlift, regional marina investment, and port economics. Key destination shifts include:

- Canada overtaking Mexico as the most popular international destination among the top 10% because of proximity and perceived safety, increasing cross-border short-break traffic and private aviation hops to secondary airports.

- Costa Rica gaining traction over traditional Caribbean stays due to luxury resort development and expanded air service; this trend supports increased demand for private charters, marina upgrades, and activity providers.

- Growing interest in the Middle East, notably Dubai, among younger affluent travelers—this alters long-haul routing and creates new demands for premium transit and superyacht marina infrastructure.

Operational implications for maritime and aviation sectors

Operators must align product mix and distribution to capture affluent demand while managing resilience risks:

- Adjust aircraft seating classes and seasonal frequencies to match higher per-passenger revenue from premium travelers.

- Rebalance cruise deployment from mega-ships to boutique, high-amenity vessels that require different port infrastructure and smaller tender operations.

- Invest in marinas and port services that support superyacht calls, provisioning chains, and rapid turn logistics for private yachts and charters.

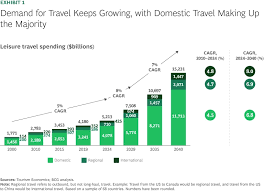

Historical context: concentration of luxury travel demand

The concentration of travel spending among an affluent minority has deepened over the past two decades. Since the mid-2000s, longitudinal tracking of high-net-worth travelers shows a steady rise in the share of leisure outlays going to premium experiences, coinciding with the growth of niche luxury brands, private aviation access, and experiential tourism. The 2008 financial crisis temporarily altered patterns, but the affluent segment rebounded faster than the broader market, accelerating investment in branded residences, ultra-luxury cruising, and wellness resorts. This historical trajectory explains why current investment and infrastructure choices favor smaller, higher-margin projects over mass-market expansions.

Strategic recommendations for destinations and operators

Five priority actions

- Focus on affluent demand: Understand top source markets and tailor airlift and berth capacity accordingly.

- Prioritize experiences: Emphasize nature, culture, and wellness programming that command higher yields than commodity services.

- Design for authenticity and resilience: Build flexible supply chains for luxury provisioning and staff training to maintain service continuity.

- Integrate platforms: Combine hotels, branded residences, and private clubs to capture lifetime value and simplify logistics.

- Leverage digital channels: Maintain visibility across AI-driven distribution and concierge platforms to capture premium bookings.

Outlook for international tourism and the marine segment

As affluent travelers concentrate more leisure spend, expect a reorientation of tourism infrastructure toward premium services—this includes growth in charter operations, superyacht calls, marina upgrades, and high-end resort investments. Destinations that can offer safe, proximate, and experiential programming—whether beach or mountain, sea or lake—will attract larger shares of affluent itineraries. For sailing, yachting, and boating providers, the trends point to higher demand for specialized charters, experienced captains, and turnkey services that cater to wellness, fishing, and bespoke on-water activities.

The consolidation of travel spending among the top 10% and 1% signals both opportunity and risk: opportunities to capture higher yields through targeted product development, and risks to broader market resilience if midscale visitation lags. Strategic investment in marinas, boutique cruise capacity, and intermodal premium transfers will be decisive for destinations seeking growth.

In summary, affluent U.S. households are reshaping where and how travel dollars flow—favoring wellness, cruising, and boutique luxury—and this has clear implications for airlines, ports, marinas, and hospitality developers. For sailors and charter operators, understanding these shifts can inform fleet deployment, marina services, and tailor-made itineraries that meet demand for privacy, provenance, and exclusive experiences. For the full implications on yacht charter, boat hire, beach and marina demand, and destinations favored by affluent travelers, the international marketplace for renting sailing boats and yachts— GetBoat.com —is always monitoring these trends and can help match charters, superyacht options, and boat rentals to suit every taste and budget. The report’s core takeaways—higher trip frequency, larger per-trip spend, and preference for wellness, cruising, and small luxury properties—should guide decisions across yachting, boating, marinas, and coastal development to capture the rising tide of luxury leisure demand.

Wealth Concentration Fuels U.S. Leisure Travel Boom">

Wealth Concentration Fuels U.S. Leisure Travel Boom">