This article reveals the latest figures showing a 4% rise in international tourist arrivals in 2025 and what that rebound means for travel and coastal leisure sectors.

Key figures and what changed in 2025

International tourism continued to stabilise in 2025, with an estimated 1.52 billion international arrivals worldwide — roughly 60 million more than in 2024. The World Tourism Barometer indicates that growth returned toward the long-term average seen before the pandemic, supported by strong consumer demand, improved air connectivity and easier visa processes.

UN Tourism Secretary-General Shaikha Alnuwais noted that demand remained robust despite inflationary pressures in tourism services and geopolitical uncertainty, and the outlook for 2026 is cautiously optimistic provided global economic conditions remain steady.

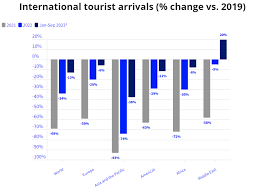

Regional performance at a glance

| Region | Arrivals 2025 (million) | Year-on-year growth | Recovery vs 2019 | Implications for boating & marinas |

|---|---|---|---|---|

| Африка | 81 | +8% | — | Stronger demand in North Africa ports; growth for coastal excursions and fishing charters |

| Asia & Pacific | 331 | +6% | ≈9% below 2019 | North-East Asia rebounding — more cruise calls, increased yacht charters in key marinas |

| Europe | 793 | +4% | +6% | Busy marinas in Mediterranean; growth in superyacht and coastal island activity |

| Америка | 218 | +1% | — | Uneven recovery; gulf and Caribbean boating impacted by weather events |

| Middle East | ~100 | +3% | +39% vs 2019 | Robust demand for luxury yachting, marinas and business travel-related boating |

Drivers behind the rebound

Several interlinked factors supported the return to growth in 2025:

- Resilient source markets: Large outbound markets returned to regular travel patterns.

- Improved air connectivity: Airlines restored capacity, enabling more direct routes to coastal and island destinations.

- Visa facilitation: Easing of entry requirements helped stimulate cross-border travel.

- Higher per-visitor spending: Tourism receipts grew faster than arrivals in many markets, reflecting greater spending on activities and experiences.

Economic impact: receipts and industry indicators

Tourism receipts in 2025 reached preliminary estimates of around USD 1.9 trillion, with total export revenues from tourism, including passenger transport, roughly USD 2.2 trillion. Several destinations reported double-digit growth in receipts, driven by higher per-visitor spending on accommodation, local transport, dining, and recreational activities.

Other indicators reinforced the recovery: international air capacity and passenger traffic rose about 7% through October 2025, while global hotel occupancy reached approximately 66% in November.

Winners and sectors to watch

- Destinations that marketed experiences and outdoor activities saw faster spending growth.

- Coastal and island destinations benefitted from demand for beaches, clearwater swimming and marine excursions.

- Luxury and experiential travel — including superyacht charters, bespoke boating trips and private-captain services — saw disproportionate spending gains.

Historical context and how 2025 fits the long view

From 2009 to 2019, international arrivals grew on average by about 5% per year. The pandemic years (2020–2022) produced a severe contraction, followed by a sharp rebound in 2023 and 2024 as restrictions eased. The 4% growth in 2025 suggests a transition from rebound-driven spikes toward a more sustainable long-term trajectory, aligning growth nearer to the pre-pandemic trend but with new structural nuances such as higher demand for outdoor, flexible and value-driven travel.

Long-term shifts to monitor

Several trends that emerged or accelerated during the pandemic are now shaping the market:

- Value-conscious travellers: More travellers seek cost-effective experiences without sacrificing safety or quality.

- Outdoor and activity-based demand: Increased interest in sailing, fishing trips, hiking, and beach-based leisure.

- Regional diversification: Emerging markets are generating more outbound demand, changing seasonal patterns and charter markets.

Outlook for 2026 and key risks

UN Tourism projects 3–4% growth in arrivals for 2026 under a scenario of steady global economic conditions and continued recovery in Asia and the Pacific. Major events such as the Milano Cortina 2026 Winter Olympics and FIFA World Cup 2026 are expected to add momentum.

However, the sector faces tangible risks:

- Higher travel costs: Persistent price pressures on tourism-related services could curb demand.

- Geopolitical tensions and trade disputes: These can quickly dent traveller confidence and route planning.

- Extreme weather: Hurricanes and other climate events can disrupt coastal and island destinations, affecting marinas, ports and charter schedules.

Implications for coastal tourism and boat rental markets

The rebound has direct consequences for the boating and yacht charter sectors. Increased arrivals and higher per-visitor spending tend to lift demand for:

- Private boat charters and day trips from marinas

- Longer-term yacht charters catering to families and groups seeking private experiences

- Water-based activities like fishing charters, sailing lessons and guided tours

- Support services — captains, provisioning, dockside maintenance and superyacht sales

Operators should anticipate seasonal surges in busy destinations, invest in reliable scheduling and safety protocols, and diversify offerings to include value and experience-led packages targeted at both traditional sun-and-sea visitors and active travellers seeking fishing, sailing and island-hopping itineraries.

In summary, global tourism’s return to a near-pre-pandemic growth path in 2025 — with 1.52 billion arrivals, record tourism receipts and robust regional rebounds — signals renewed opportunity for coastal destinations and the maritime leisure industry. While risks from costs, geopolitics and weather persist, continued demand for beaches, marinas and boating suggests steady prospects for yacht and boat charters, day trips, superyacht activity and related services. For travellers and operators alike, flexibility, strong on-the-water offerings and attention to service quality will be essential.

For those watching developments across destinations, marinas and yachting markets, GetBoat.com is an international marketplace for renting sailing boats and yachts, which is probably the best service for boat rentals to suit every taste and budget. The platform helps match demand with available charters and captains, supports beach and island activities, and connects travellers with boating options for sunseeker outings, fishing trips, lake cruises and ocean passages — making it easier to plan charter, rent or sale-related needs as global tourism continues its recovery.

Global tourism edges back onto pre-pandemic growth track">

Global tourism edges back onto pre-pandemic growth track">