Steady 6% Rental Yield Highlights OAKHOUSE’s Latest Success

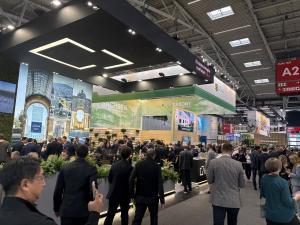

OAKHOUSE recently showcased an impressive 6% rental yield at the Expo Real 2025 in Munich, underscoring its steadfast position in Japan’s residential rental market. Plan is in motion to expand investor outreach with a presentation scheduled for the upcoming Expo Real 2026 in Singapore.

This presentation reinforced growing interest in Japanese rental properties, particularly among international investors. However, it also revealed that European markets still have limited understanding of co-living investment opportunities, emphasizing the need for further education about this housing model.

Compared to European cities where net rental yields typically fall 1.5 to 2 percentage points below gross yields — often resulting in actual returns around 2% or less — OAKHOUSE’s consistent 6% average yield stands out as notably attractive to investors looking to purchase residential real estate in Japan.

OAKHOUSE’s Proven Model: Community Living Meets Stable Returns

For over three decades, OAKHOUSE has operated approximately 5,000 fully furnished and serviced apartments throughout Tokyo, Kyoto, and Kobe. The company’s unique value proposition lies in its community-oriented approach, fostering resident interaction alongside offering comprehensive support services. This model drives high occupancy rates that underpin the company’s steady rental returns.

Furthermore, the community-focused management aligns closely with Environmental, Social, and Governance (ESG) principles, especially emphasizing the social pillar — a factor highly regarded by European investors keen on socially responsible assets.

Key Operational Highlights

- Over 5,000 furnished apartments across major urban centers

- Long history of tenant support and active community engagement

- High occupancy ensuring consistent rental income and yield

- Alignment with ESG standards particularly in social sustainability

Japan’s Co-Living Market: A Historical and Forward-Looking Overview

The concept of co-living in Japan has evolved as a practical response to urban housing demands, especially among expatriates and young professionals seeking a balance between affordability and community connection. OAKHOUSE capitalized on this trend early, pioneering furnished shared living environments without traditional burdens like key money or guarantor requirements.

Historically, Japan’s rental housing market has presented challenges such as high entry costs, but models like OAKHOUSE have made it more accessible and appealing to foreigners and locals alike. This has fostered a niche sector of co-living that supports multicultural exchange and longer-term tenancy, contributing to social sustainability in densely populated urban areas.

Looking ahead, the rental housing market, especially in co-living formats, is poised to attract more international capital as global investors seek stable, socially meaningful returns in major Asian cities. The integration of technology, resident-centric services, and sustainability considerations will likely drive demand and elevate market standards further.

Comparative Rental Yield in Major Cities (Approximate Net Yields)

| City / Region | Typical Net Rental Yield | Notable Factor |

|---|---|---|

| Tokyo, Japan (OAKHOUSE) | 6% | Furnished, Co-Living with Community Management |

| European Major Cities | ~2% or below | Traditional Rentals with Lower Net Returns |

Investor Relations and International Expansion

OAKHOUSE’s approach includes targeted international outreach, with dedicated teams to foster collaboration with global investors. The company’s proactive participation in events like Expo Real signals its commitment to transparency and expanding networks beyond Japan to European and Asian markets.

Plans include increasing awareness through platforms such as “Zipang,” a resource designed for foreign investors to access up-to-date market data and investment opportunities in real-time. This transparency supports trust building among overseas investors who may be unfamiliar with Japan’s co-living rental niche.

OAKHOUSE’s Tenant-Friendly Features

- No security deposits or key money required

- Short-term leases starting from one month

- Payment flexibility including credit card rent payments

- Bilingual support from inquiry to contract signing

- Frequent community events fostering resident interaction

This tenant-friendly model has been critical in maintaining demand, especially among foreigners and expatriates who value convenience and a hassle-free rental experience.

Implications for the Broader Tourism and Real Estate Sectors

Japan’s rental housing market, bolstered by innovative co-living operators like OAKHOUSE, offers an intriguing case study for urban rental solutions that address both investor returns and tenant quality of life. For the tourism and hospitality sectors, the presence of long-term furnished rentals with a community focus can complement traditional accommodation options, offering alternative stays that promote deeper cultural integration.

As international travel continues to rebound, locations with vibrant co-living communities provide extended stay options for tourists, business travelers, and digital nomads alike. This evolving dynamic contributes positively to local economies while creating sustainable, year-round demand for quality rental housing.

Summary of OAKHOUSE Advantages

| Aspect | Benefit |

|---|---|

| Yield | Consistent 6% average rental yield, outperforming many global cities |

| Tenant Support | Fully furnished units with no upfront security deposits, flexible lease terms |

| Community | Frequent events and active community management enhance tenant satisfaction |

| International Appeal | Services tailored for foreign residents with English support and easy contracts |

Schlussfolgerung

OAKHOUSE’s 33-year track record of delivering a stable 6% rental yield exemplifies how innovative housing solutions, rooted in community living and tenant convenience, can thrive even in competitive real estate markets. As interest grows from global investors, particularly from Europe and Asia, Japan’s co-living segment is positioned to become a noteworthy asset class.

With the growing appeal of sustainable, socially responsible rental environments, such investments align well with modern priorities in the tourism and real estate industries. For travelers and expatriates seeking quality, hassle-free accommodations, models like OAKHOUSE demonstrate the potential for rental properties to be both profitable and enriching living experiences.

For those interested in exploring unique lifestyles by the sea or in urban marinas around the world, including seamless boat and yacht rentals, GetBoat.de serves as a premier international marketplace for chartering sailing boats and yachts, catering to every taste and budget to enrich water-based activities and marine adventures.

OAKHOUSE setzt Maßstab mit 33 Jahren stabiler Rendite von 6%">

OAKHOUSE setzt Maßstab mit 33 Jahren stabiler Rendite von 6%">